Cost Allocation: What It Is, Why It Matters, and How Businesses Actually Use It

Learn what cost allocation is, the difference between direct and indirect costs, and the 3 most common cost allocation methods.

What Is Cost Allocation?

Cost allocation is the way a business figures out where its costs truly belong. When you run a company, you don’t just pay for things that clearly belong to one product or one team. You also pay for rent, software, utilities, systems, and support functions that exist because the business exists.

Cost allocation is how you reasonably split those shared costs so you can understand:

- What each part of your business actually costs

- Which activities are profitable

- Where money is being wasted

Types of Costs

Before a business can allocate costs, it first needs to understand what kind of costs it is dealing with. Not all costs behave the same way, and not all costs should be treated equally. Some costs already belong clearly to one part of the business, while others exist only because the organization operates as a whole. Cost allocation is mainly concerned with the second group.

At a high level, business costs fall into two broad categories: direct costs and indirect costs.

Direct Costs

Direct costs are costs that can be clearly and confidently attributed to a specific product, service, project, or department. Because their ownership is already known, these costs do not need to be allocated. They are assigned directly.

The key test for a direct cost is simple: if the product, service, or department did not exist, the cost would not exist either. For example, a laptop purchased for a specific employee is a direct cost. Or, a software license bought exclusively for the design team is also a direct cost.

Indirect Costs: Primary Focus For Cost Allocation

Indirect costs are costs that support the business as a whole rather than one specific product, service, or department. These costs exist because the company operates, not because any single activity exists on its own. Many indirect costs are also shared costs, meaning they benefit multiple parts of the business simultaneously. This is why they must first be identified and grouped before being allocated using a reasonable basis.

For example, an email system is used by every employee, regardless of department. Network infrastructure allows all teams to access internal systems. HR systems support hiring and payroll across the entire organization. None of these costs belongs clearly to one team, yet the business cannot operate without them.

Indirect costs can be further understood by looking at how they behave when activity levels change. This is where the distinction between fixed and variable costs becomes important.

Fixed Costs

Some indirect costs are fixed for a given period. They remain stable regardless of short-term changes in usage or output. A common example is the salary of a project supervisor assigned to a specific division. Whether the team produces more or less in a given month, the supervisor’s remuneration stays the same.

Let’s take another example with the software license management process. Annual contracts for company-wide IT asset management (ITAM) software or long-term infrastructure agreements often behave the same way. Once the contract is signed, the cost is locked in for the period, even if usage fluctuates.

Variable Costs

Variable costs rise and fall with activity levels. As output increases, they increase; as output decreases, they decline. In traditional operations, this might include utilities or support costs tied to production volume.

In IT, cloud infrastructure is the clearest example. Compute, storage, and data transfer costs grow as systems are used more heavily and shrink when activity drops. These costs are still indirect because they support multiple systems or teams, but their behavior makes them more sensitive to how resources are consumed.

Cost Allocation Methods

Once a business understands which costs are shared, the next step is deciding how to allocate them in a way that reflects reality and supports better decisions. There is no single method that works for every situation. Different costs behave differently, and the right approach depends on what drives the cost and who benefits from it.

Below are three of the most common and practical cost allocation methods used by businesses.

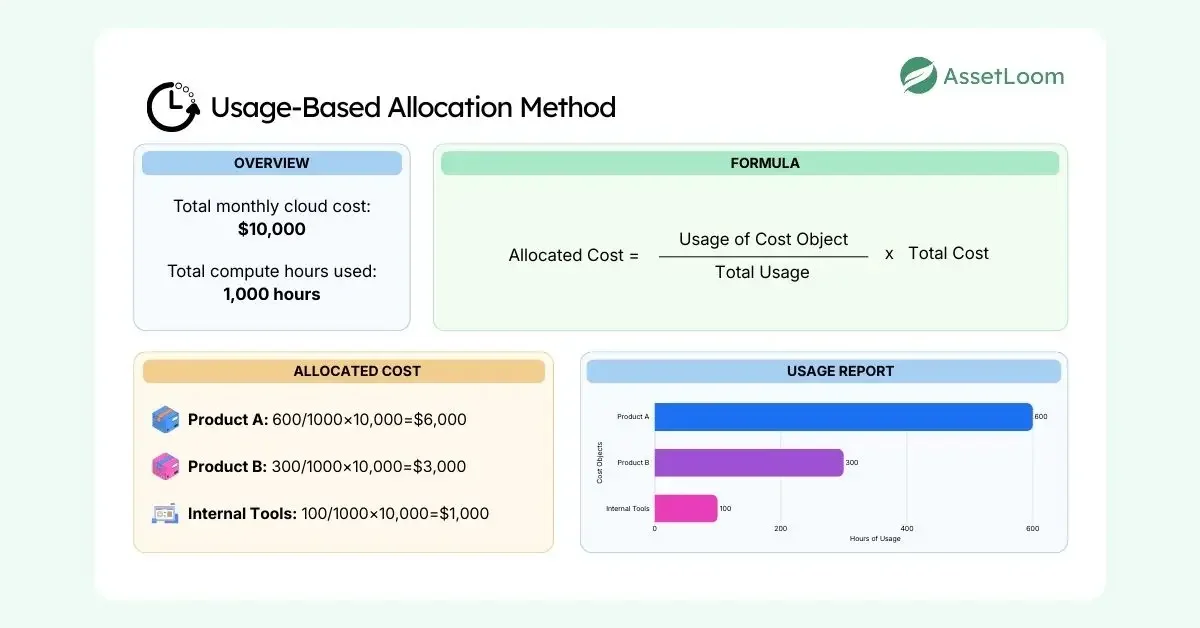

1. Usage-Based Allocation

Usage-based allocation assigns costs based on actual consumption. The more a team, product, or service uses a shared resource, the larger the share of the cost it receives. This method assumes that usage is the primary driver of the cost.

Example

A company spends $10,000 per month on cloud infrastructure. Product A uses 60% of the compute resources, Product B uses 30%, and internal tools use 10%.

Using usage-based allocation:

- Product A is allocated $6,000

- Product B is allocated $3,000

- Internal tools are allocated $1,000

What this shows

The total cost stays the same, but the business can now see which product is actually driving cloud spend. Instead of treating cloud costs as general overhead, leaders can identify where optimization efforts matter and avoid blaming the wrong teams.

Best for

Usage-based method works best for costs that scale directly with activity or consumption, such as cloud services, usage-based software, utilities, or transaction-driven platforms.

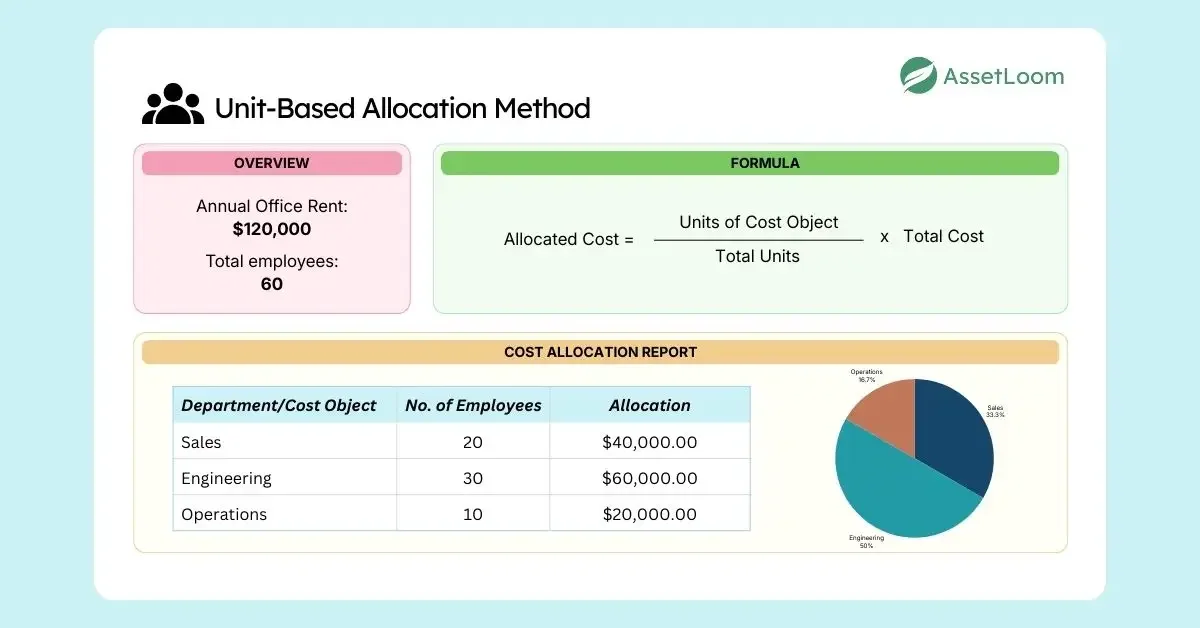

2. Headcount or Unit-Based Allocation

The headcount or unit-based allocation method allocates costs based on a simple, countable factor such as the number of employees, users, devices, or licenses. It assumes that each unit consumes a roughly similar share of the resource.

Example

Office rent is often allocated by headcount, because more people generally require more space and facilities.

For example, a company pays $120,000 per year for office rent. Sales has 20 employees, Engineering has 30, and Operations has 10, totaling 60 employees.

Using headcount-based allocation:

- Sales is allocated $40,000

- Engineering is allocated $60,000

- Operations is allocated $20,000

What this shows

The rent cost is spread based on team size. Larger teams carry a larger share of the cost, which makes sense when the cost exists mainly to support people rather than specific activities.

Best for

This method is best for shared costs that exist primarily to support people or standardized units, such as office facilities, HR systems, company-wide software, and equipment.

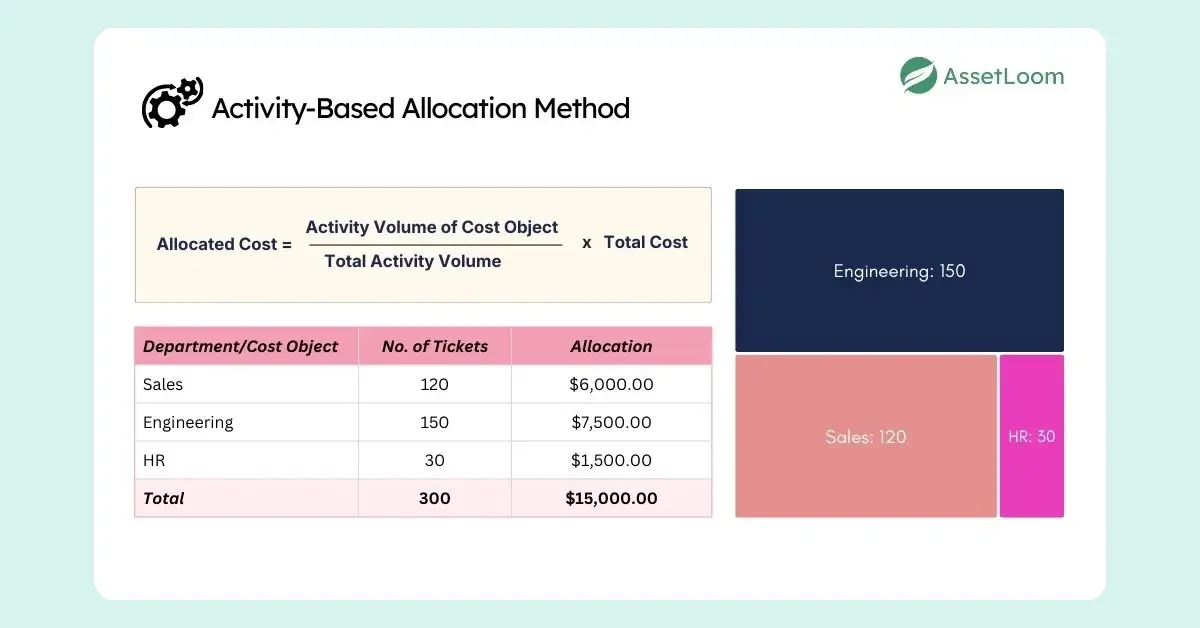

3. Activity-Based Allocation

Activity-based allocation assigns costs based on the amount of work performed for each cost object. Instead of measuring usage of a resource, it measures effort, actions, or services delivered.

Example

Let’s take Customer Support as a solid example, as Customer Support costs can be allocated based on the number of tickets handled for each product.

A company spends $15,000 per month on IT support. Sales generated 120 support tickets, Engineering 150, and HR 30, for a total of 300 tickets.

Using activity-based allocation:

- Sales is allocated $6,000

- Engineering is allocated $7,500

- HR is allocated $1,500

What this shows

Support costs follow actual demand. Teams that require more support carry a larger share of the cost, instead of the cost being treated as general overhead.

Best for

This method works best for service-oriented functions where effort varies significantly across teams or products, such as support, operations, IT services, or project-based work.

Why Anyone Running a Business Needs to Know This

Cost allocation does not change how much a business spends. It changes how costs are understood. When shared costs are left unallocated, they tend to sit in central teams or general overhead.

This leads to false conclusions. Teams may be judged as inefficient simply because they carry shared costs. The same issue appears when evaluating products or services. A product may look highly profitable simply because it only carries its direct costs. Shared systems, support functions, and infrastructure costs are not assigned to it, even though the product depends on them to exist. Decisions based on these partial views often miss the real drivers of cost.

Understanding cost allocation helps business owners see where costs are actually caused and who benefits from them. With that clarity, discussions about efficiency, pricing, and investment become more accurate, and decisions are based on reality rather than appearances.

Final Thought

Cost allocation is not about making your accounting more complex. It is about making your business easier to understand. When shared costs are left unexamined, they distort how teams, products, and services appear on paper. When those costs are allocated in a reasonable and consistent way, they reveal where money is actually being spent and why.

You do not need perfect accuracy to benefit from cost allocation. You need clarity. By understanding which costs are direct, which are shared, and how to allocate them using simple methods, business owners can make decisions based on the full picture instead of partial signals.

Frequently Asked Questions

1. Is cost allocation only relevant for large companies?

No. Cost allocation becomes more visible as companies grow, but even small businesses have shared costs such as rent, operational tools, or IT infrastructure support.

2. Do I need to allocate every single cost?

No. Direct costs already belong where they should and do not need allocation. Cost allocation mainly applies to indirect and shared costs, and even then, businesses should focus on costs that meaningfully affect decisions.

3. Is cost allocation the same as reducing costs?

No. Cost allocation does not reduce spending on its own. It changes how costs are understood and where they are visible, which can then lead to better decisions about optimization or investment.

4. What if my allocation is not perfectly accurate?

Perfect accuracy is not the goal. A simple, consistent allocation that reflects reality is usually far more useful than a complex model that no one understands or trusts.

5. Can a business use more than one allocation method?

Yes. Most businesses use different allocation methods for different types of costs. For example, usage-based allocation for variable costs and headcount-based allocation for people-related costs. The key is choosing methods that fit how each cost behaves.

AssetLoom is the IT Asset Operations Platform (AssetOps) that gives organizations total control over their hardware, software, contracts, and workflows. By unifying lifecycle management, financial optimization, governance, and automation, AssetLoom delivers visibility and operational control across the entire IT environment.